First time home buyer programs low credit scores

Nurses with a credit score of 580 or higher can qualify for a. NO CREDIT SCORE FHA MORTGAGE LENDERS OFFER MINIMAL DOWN PAYMENT AND FEES.

Texas Tx First Time Home Buyer Programs For 2022 Smartasset

First Time Home Buyers.

. Best for low or bad credit scores overall. The Freddie Mac Home Possible First Time Home Buyers Program is one of the best ways to get a Home Loan With A LOW Credit Score and with Zero Down PaymentWi. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement.

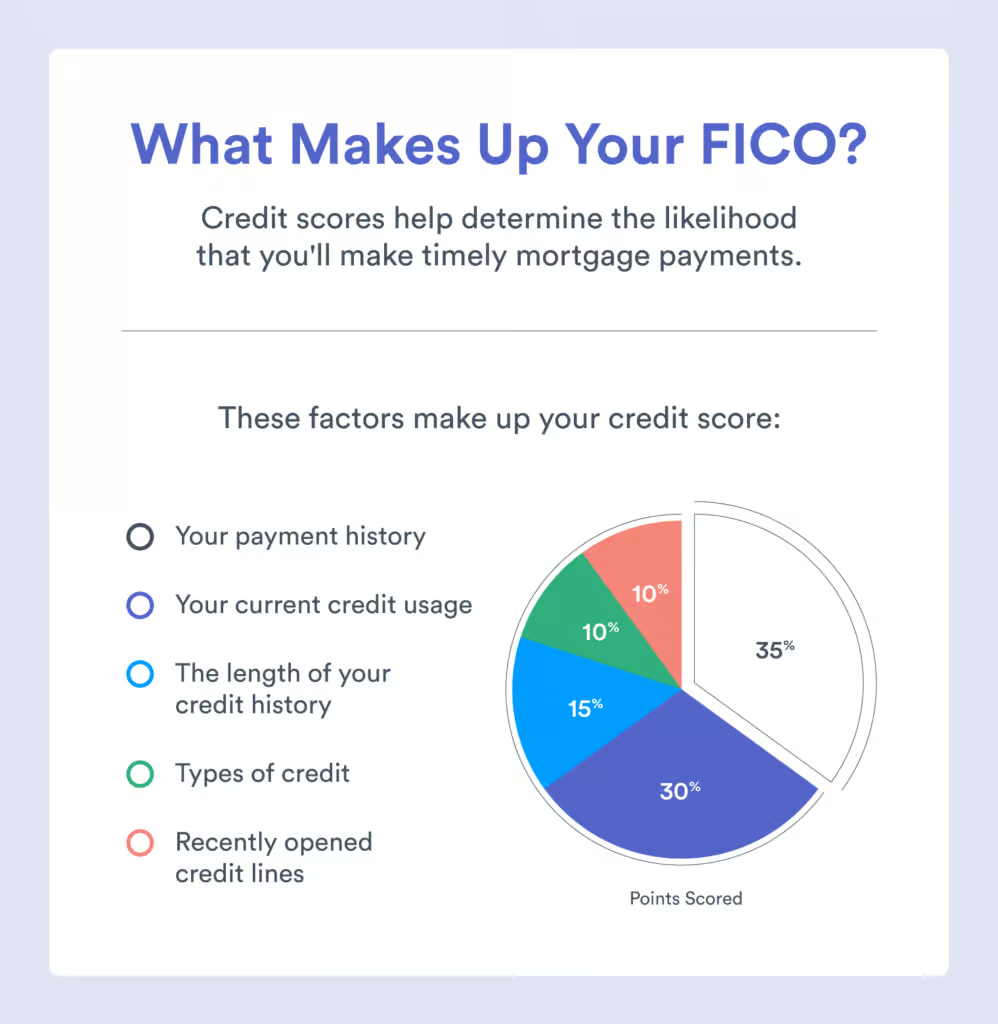

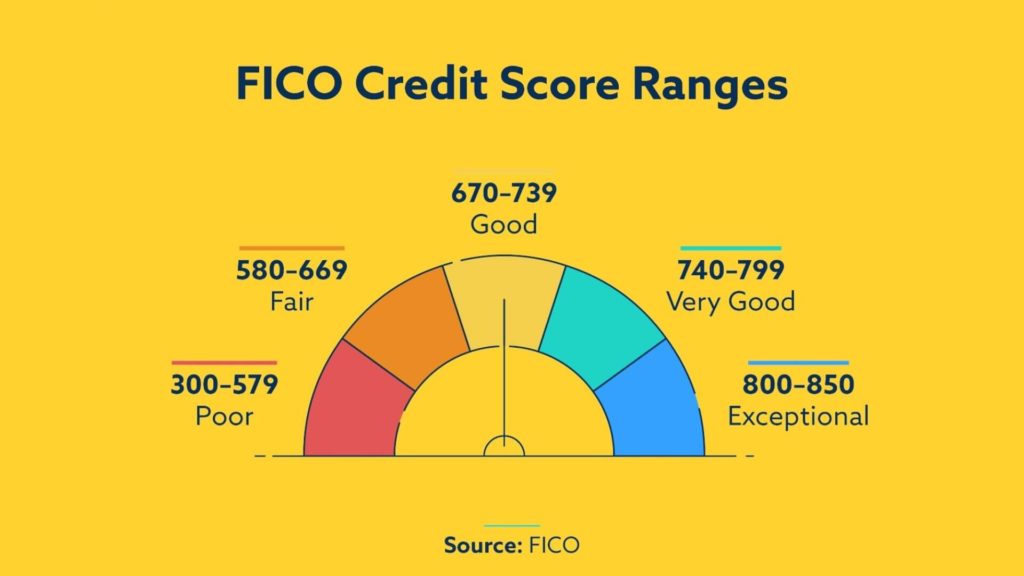

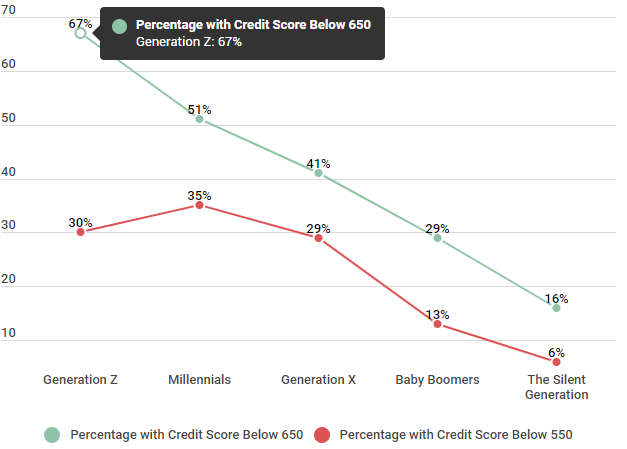

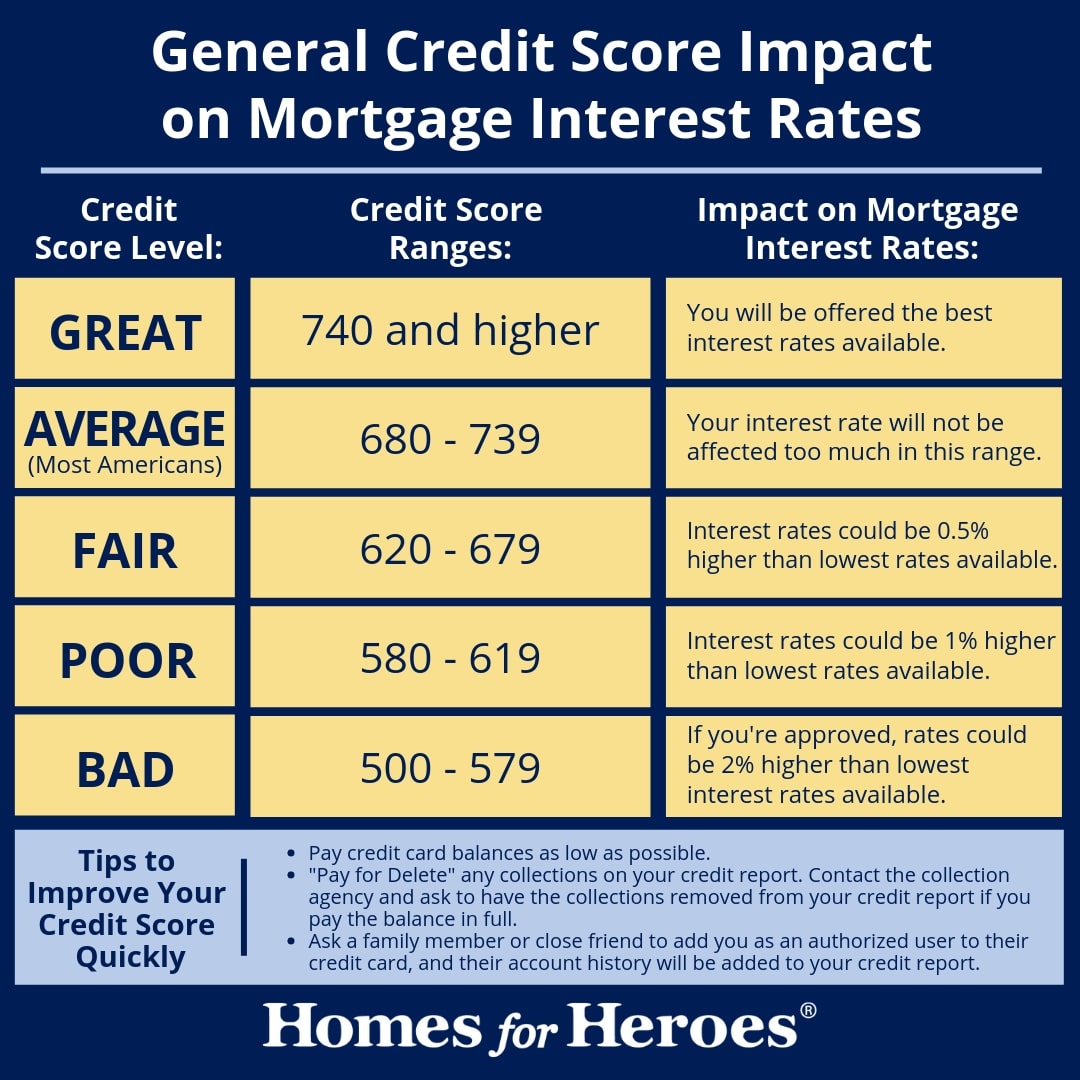

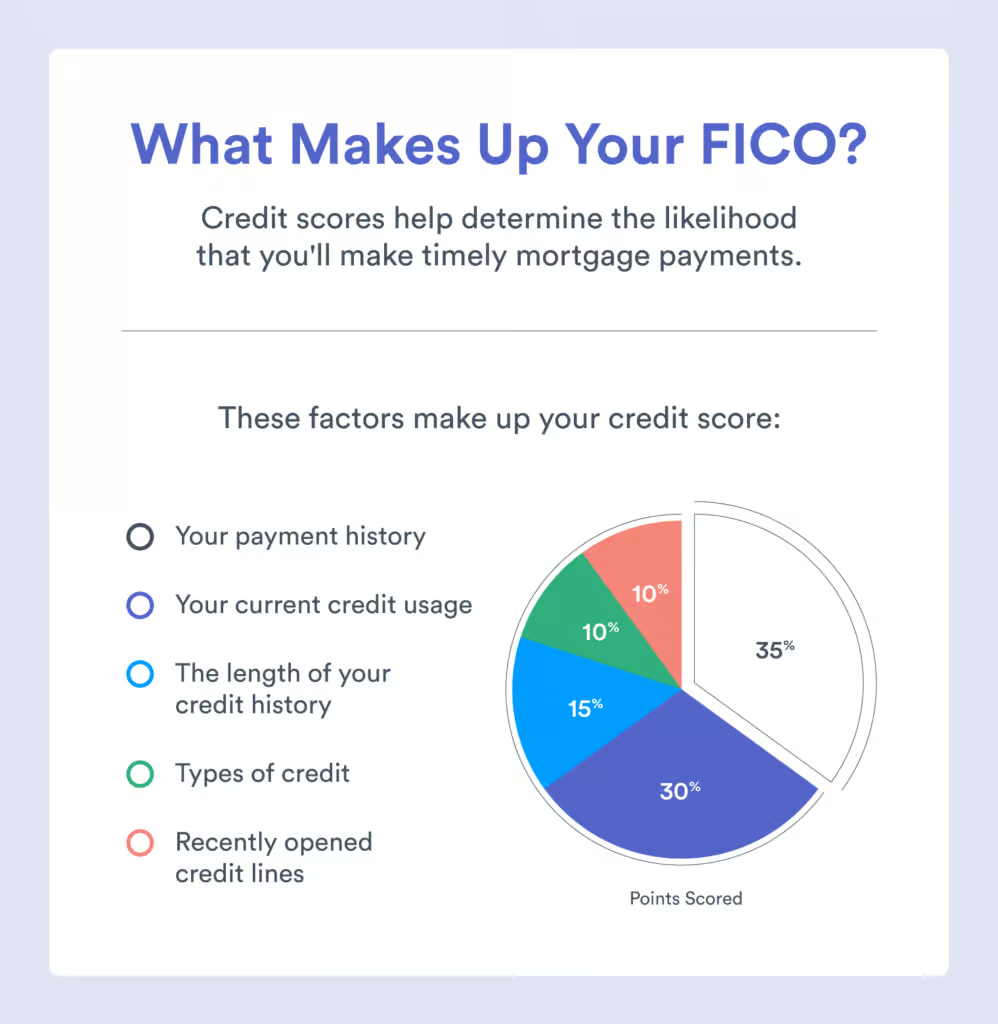

A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance. Homebuyers with less than perfect credit scores can use FHA loan options. In late 2021 FICO reported borrowing rates ranging from 2576 for homebuyers with credit scores of 760 and above to 4165 for those with credit scores 620-639.

A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance but this varies. Florida First-Time Homebuyer Stats for 2022. Home Buyers with less then credit scores can use FHA loan options.

Buyers with credit scores of. Best for FHA loans. Home Buying Programs Home Buying.

Home Buyers with credit scores as low as 640 can use our FHA low 35. FHA and USDA loans for first-time buyers can offer low down payments reduced interest and other benefits and so can many state and local programs. Best for first-time home buyers.

In as few as 30 days youll start to see. Home loans start with low Convetional 3 and FHA 35. New American Funding.

First Time Home Buyer. Heres a snapshot of Florida homebuyers according to the 2021 National Association of Realtors Profile of Buyers and Sellers. Pay your bills on time every time.

Your 1st CHOICE Home Loan Lender. DPA programs often exist to help first-home buyers low-income families or otherwise disadvantaged buyers. The program provides public housing residents and others with a low income who are first-time homebuyers with subsidies to use toward buying a home.

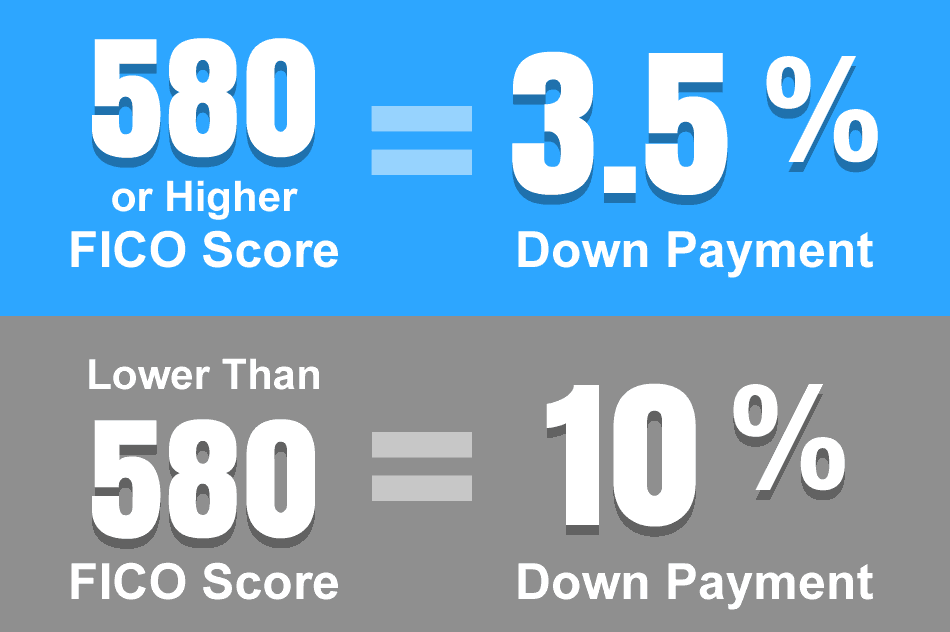

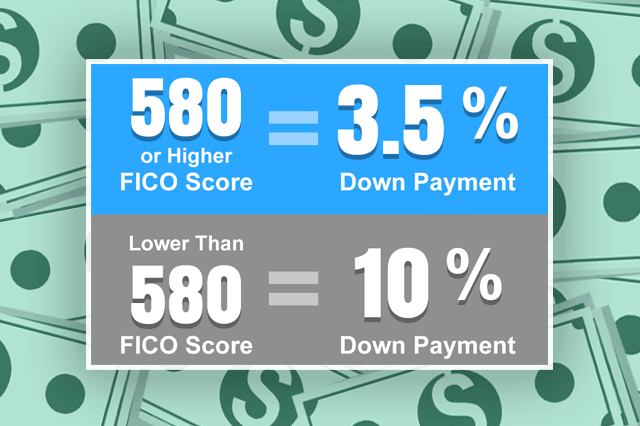

If you only have cash on hand that can pay for 35 of your homes purchase price then a minimum credit score of 580 will be good enough for an FHA loan. In additions bad credit no credit mortgage applicants will find the FHA. Home loans start with low Convetional 3 and FHA 35.

Another terrific way to improve your credit score is to make on-time payments to your creditors. Down payment only 35 of the purchase price down payment assistance and closing.

What Is A Credit Score Bayou Mortgage

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

How To Buy A House With Bad Credit Nerdwallet

How To Buy A House With Bad Credit Improve Your Credit Credit Org

How To Get A Bad Credit Home Loan Lendingtree

Buying A Home With Low Credit Score On Sale 52 Off Www Ingeniovirtual Com

600 Mortgage Loan Programs Low Credit Score Mortgages Cornerstone First Financial

Minimum Credit Scores For Fha Loans

What Is A Good Credit Score To Buy A House Or Refinance

What Credit Score Do You Need To Buy A House In 2022

Down Payment Closing Cost Assistance Learn More

What Credit Score Do You Need To Buy A House In 2022 Ally

Buying A Home With Low Credit Score On Sale 52 Off Www Ingeniovirtual Com

Fha Credit And Your Fha Loan In 2022

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Fha Mortgage Guidelines For A Kentucky First Time Home Buyer

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

12 First Time Home Buyer Mistakes And How To Avoid Them Nerdwallet