Pre tax contribution calculator

If you have any pre-tax contributions you need to deduct them from your gross yearly salary which you can also do using the calculator. PARENTAL CONTRIBUTIONS CALCULATOR How much are parents expected to contribute towards your living costs.

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

2021-2022 Tax Brackets Tax Calculator.

. So if contributing 5 percent enter 5. 290 for incomes below the threshold amounts shown in the table. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

Pre-Tax Cost Calculator. These tax refunds will be credited only to those bank accounts which are linked with PAN and are also pre-validated on the new income tax e-filing website. In contrast Roth IRA contributions are deposited using after-tax dollars and are not taxed when withdrawn during retirement.

However deduction under. This has been a guide to the 401k contribution calculator. The Dividend Calculator comes with pre-filled input parameters.

Still considered taxable income by the Internal Revenue Service IRS and must be reported. This tax calculator can provide accurate tax. If you know your tax code simply add it in our options and well adjust your personal allowance accordingly.

A pre-tax retirement account must have a custodian or financial institution whose job it is to report to the Internal Revenue Service IRS the total amount of contributions and withdrawals for the account each yearThe custodian who holds your pre-tax account will send you and the IRS a 1099-R tax form in any year that you make a withdrawal. This tool can help you estimate your annual contribution toward the cost of your health plan. For FY 2020-21 AY 2021-22 2021-2022 2020-21 with ClearTax Income Tax Calculator.

For percentage add a symbol at the end of the amount. The part of your contribution that you claim on tax is treated as a before tax contribution while the part you dont claim is an after-tax contribution. Income Tax Calculator - How to calculate Income taxes online.

A pre-tax deduction lowers tax liabilities for employers and employees. Not all pre-tax benefits are exempt from all federal tax withholdings. The income tax department had previously announced that from March 1 2019 it will issue only e-refunds.

After you see your estimated cost you can select up to three plans to view a side by side comparison of each plans benefits. Net Income - Please enter the amount of Take Home Pay you require. 1040 Tax Estimation Calculator for 2022 Taxes.

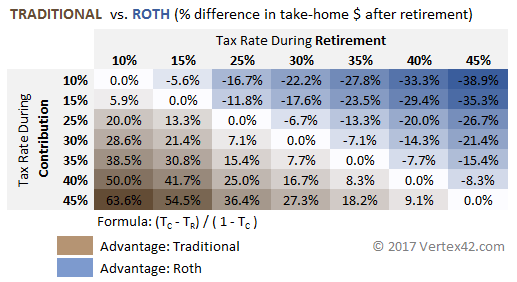

To add extra to your super you need to pass the government work test by working at least 40 hours in any 30 days in this financial year. If separated its the parent you live with more. The big difference between traditional IRAs and Roth IRAs is when taxation is applied.

Pet Insurance For Pre-Existing Conditions. 401k Contribution as discussed is a type of calculator wherein an individual can calculate the amount he can invest in a 401k plan and what amount his employer will contribute. 80-IAB 80-IAC 80-IB 80-IBA etc.

Change the parameters to see the calculated results. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. No matter what the Contribution Every value is this amount should represent the total annual contribution amount.

Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. Total rounded to nearest 50. Estimate Tax Payments.

Not to exceed annual plan limit of. If you earn 20000 a year then after your taxes and national insurance you will take home 17529 a year or 1461 per month as a net salary. If you are age 50 or older this is the additional amount above the Pre-tax and Roth Combined Annual Contribution Limit and above the Total Annual Contributions Limit that you are allowed to contribute on a pre-tax basis which is 6500 in 2022.

Utilizing the maximum contributions limit helps reduce your tax liability. Medicare tax rate is 145 total including employer contribution. 09 on top of.

To do so you can use a tax calculator. The formers contributions go in pre-tax usually taken from gross pay very similar to 401ks but are taxed upon withdrawal. This is the NET amount after Tax the actual amount that you get paid after all deductions have been madeIf you select month and enter 3000 we will calculate based upon you taking home.

Combined parents household pre-tax income after pension contributions. If you take a. The maximum TFSA contribution limit was 6000.

For example an employee who retires will owe taxes when they withdraw money from a pre-tax 401k plan. Enter your filing status income deductions and credits and we will estimate your total taxes. You will also be able to see a comparison of your pre-budget and post-budget tax liability old tax slabs and new tax slabs.

Incomes above the threshold amounts will result in an additional 045 total including employer contribution. Based on a 40 hours work-week your hourly rate will be 843 with your 20000 salary. Horizon BCBSNJs premium contribution calculator can help you manage your health care premium costs.

Here is a step-by-step guide to pre-validate a bank account on the new income tax portal. This is one plan wherein an individual can defer tax payments. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

As a default the tax code for the latest financial year 20202021 is L1250. Our system supports all widely used tax codes such as L codes BR codes M codes and D0 D1 NT 0T K N and S codes. Income from salary after standard deduction of Rs.

If contribution 50 enter 50. The calculator will automatically adjust and calculate any pension tax reliefs applicable. Income from Salary Income from salary after standard deduction of Rs.

The maximum catch-up contribution available is 6500 for. You can accumulate TFSA. However the employee might owe taxes in the future when they use the benefits.

Combined parents household pre-tax income after pension contributions. State income tax deduction or credit for your contribution to that states 529 plan.

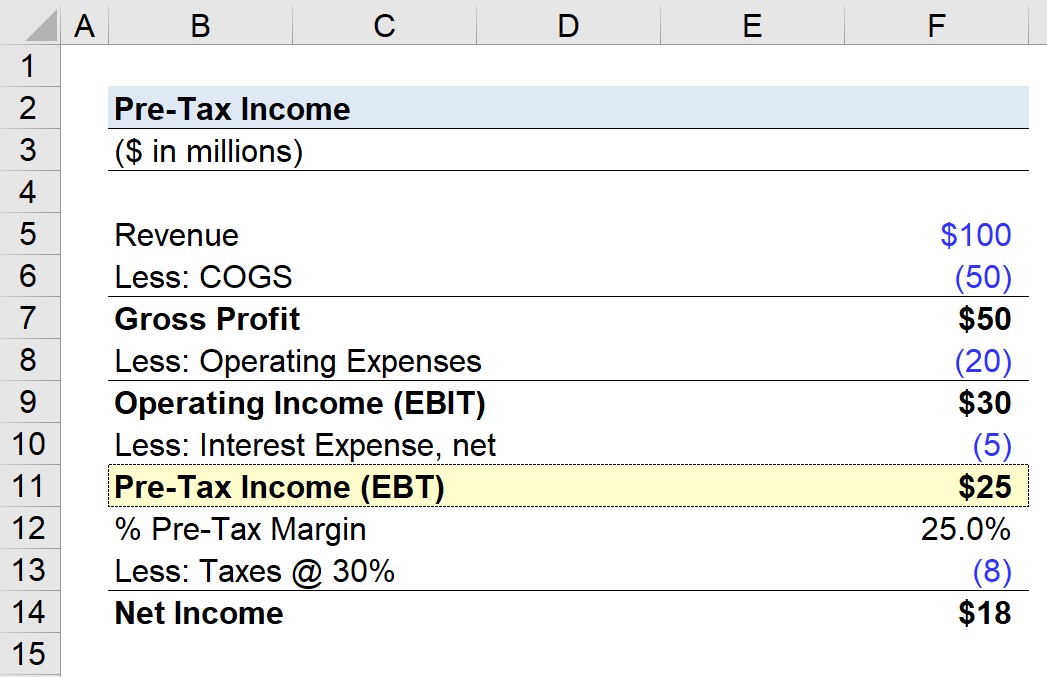

Pre Tax Income Ebt Formula And Calculator Excel Template

Pre Tax Income Ebt Formula And Calculator Excel Template

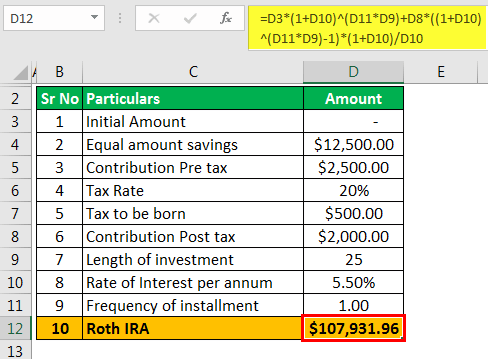

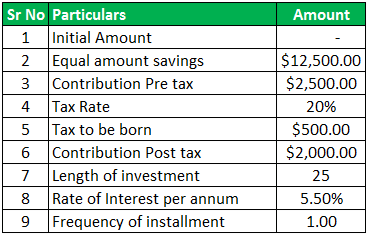

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Roth Ira Contribution

Paycheck Calculator Take Home Pay Calculator

Solo 401k Contribution Limits And Types

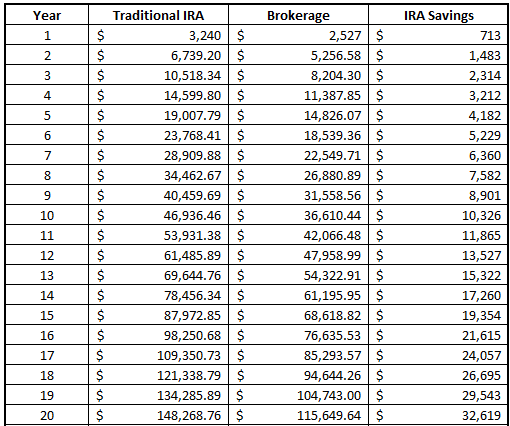

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paycheck Calculator Take Home Pay Calculator

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Different Types Of Payroll Deductions Gusto

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

After Tax Contributions 2021 Blakely Walters

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal